Angel One Review 2024

- Home

- Angel One Review 2024

![]() was established in India in 1987 as one of the premier full-service retail brokers offering discount brokerage online brokerage services, providing stock and commodity broking, investment advisory services, margin funding loans against shares as well as financial product distribution to their client base.

was established in India in 1987 as one of the premier full-service retail brokers offering discount brokerage online brokerage services, providing stock and commodity broking, investment advisory services, margin funding loans against shares as well as financial product distribution to their client base.

As per the 2024 report, Angel One has a market cap of ₹32,536.68 Cr and a 52wk high/low of ₹3,896 & ₹999 respectively. Angel One is a registered broker with SEBI, NSE, BSE, MCX, and NCDEX that is backed by 4,000+ employees. The company creates a PAN India presence with 110 branches, 110000 trading terminals, and over 1.2+ million retail clients in 1800+ cities and towns.

Angel One recently revamped its brokerage plans in response to discount stock brokers like Zerodha. Under its flat rate brokerage plan ‘Angel iTrade PRIME, Angel One now provides intraday, F&O, Currencies, and commodity trading at Rs 20 per trade except Equity Delivery which remains free for users; all exchanges & segments use one simple rate that applies across them all.

Angel One is well known for its superior trading software and investment advisory. Angel is also a highly-respected full service broker offering discounted brokerage rates to their customers. Users can easily do trading and investments in each corner and every time with an advanced super mobile app.

The cost of trading is highly competitive and charges a flat fee of Rs 20 per order for all trades executed in any segment with various advantages such as free stock market research and advisory services, including fundamental and technical research reports for investment and trading ideas as well as IPO research. In addition, it also allows investment in US stocks and ETFs, SGBs, and provides margin trading, and loans against shares.

Angel One Charges 2024

Angel One provides genuine discount brokerage services with a transparent pricing structure, where the maximum brokerage fee is 20 Rupees per order. It provides commission-free trading in all offered delivery segments (investments in stocks), and intraday trades are charged lower than Rs 20 or 0.03%. When you start trading With Angel One, you don’t have to pay any charges in the first 30 days:

| Angel One Charges | Charges |

| Account Opening Fees | Free |

| Brokerage on Delivery Trade | Free |

| Pledge Creation / Closure | ₹ 20 Per ISIN ₹ 50 Per ISIN For BSDA Clients |

| Demat | ₹ 50 Per Certificate |

| Remat | ₹ 50 Per Certificate + Actual CDSL Charges |

| DP Charges | ₹ 20 Per Debit Transaction ₹ 50 Per Debit Transaction For BSDA Clients |

Account Maintenance Charges | Free for 1st Year |

| From 2nd Year onwards… Non-BSDA Clients ₹ 20 + Tax / Month For BSDA (Basic Services Demat Account) Clients: – Holding Value Less Than 50,000 : NIL – Holding Value Between 50,000 To 2,00,000 : ₹ 100 + Tax / Year | |

| Call & Trade / Offline Trade | Additional Charges Of ₹ 20 / Order |

Angel Itrade Plan

Account Opening.

₹0

Research Reports & Trading Calls

Yes

Option Strikes Allowed

All Strikes

per Order for order value greater than ₹50,000.

₹30

per Order for order value less than ₹50,000.

₹15

Broker Type

Full Service

Angel Itrade Prime Plan

Account Opening.

₹0

Research Reports & Trading Calls

Yes

Option Strikes Allowed

All Strikes

Equity Delivery

₹0

F&O,Order for Intraday

₹20

Broker Type

Full Service

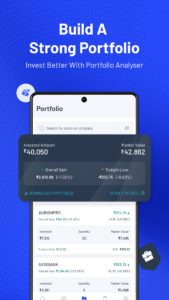

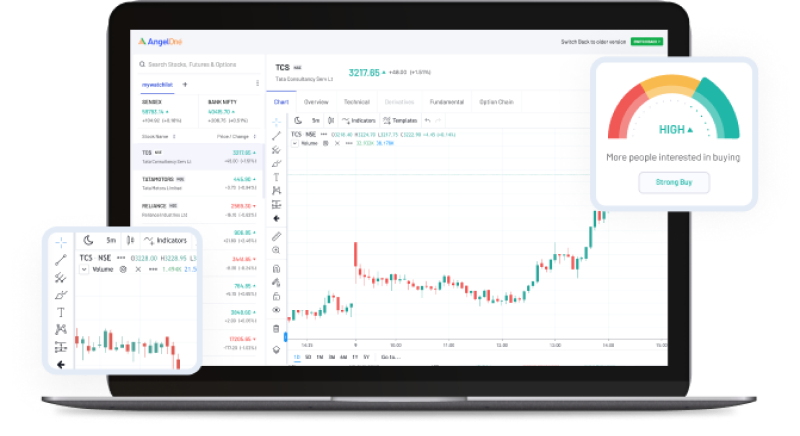

Angel One Trading Platforms for Opening Online Account

Angel One Trading Software (Angel One Trading Platforms)

Angel One App (Mobile Trading App)

Angel One Trade (Website)

Angel SpeedPro (Trading Terminal)

Genuine Rating Angel One 2024

| Overall Rating | 2.7/5 |

| Fees | 3.0/5 |

| Brokerage | 3.0/5 |

| Usability | 3.0/5 |

| Customer Service | 2.6/5 |

Angel One Leverage in the Market

Angel One offers the best discount brokerage services at affordable rates. The intraday trading margin of Angel One is upto 20% of trade value with a maximum exposure of 5*, depending on the stock size. For Angel One platform F&O (Futures and Options) intraday trading, the margin is 1.3x across Equity, Currency, and Commodity trading on BSE, NSE, and MCX. Moreover, there is no additional margin provided by Angel One.

| Segment | Margin | Leverage |

| Equity Delivery | 100% of trade value | 1x |

| Equity Intraday | Up to 20% of trade value | 5x |

| F&O (Equity, Currency and Commodities) | 100% of NRML margin (Span + Exposure) | 1x |

Angel One Best 10 Highlights for 2024

- Experience leading brokerage with over 2 decades.

- Open a free Angel One trading and demat account.

- Ideal platform for all your investment needs.

- Superfast platforms; Angel One Super App and Speed Pro desktop software.

- Angel One ARQ: An AI-based advisory platform.

- No brokerage on investment stocks.

- Pay Rs. 20 brokerage on intraday and F&O trades.

- Transparent pricing structure with no hidden charges.

- Learn to earn with Angel One through blogs, knowledge centers, and smart money.

- Invest in direct mutual funds at Rs 0 brokerage.

Angel One Pros & Cons:

Below are the advantages and benefits of Angel One. It is wise to review both its advantages and drawbacks before opening an account with them; doing so can help determine if Angel One meets your investment needs or not.

Pros

- Full-service brokerage services are available at ultra-low brokerage fees.

- Flat fee stock broker charging Rs 20 per order across segments and exchanges. Brokerage free equity delivery trades.

- Training and hand-holding are available for beginners.

- Margin trading facility and securities as collateral are available.

- Do not charge for NEFT/fund transfers. (Others charge ~Rs 10 per).

- Only charge Rs 20 for intraday square-off and call & trade (others charge Rs 50).

- Free advisory/tips for stocks and mutual funds (Others do not).

- Local sub-broker/RM services even at a discount brokerage.

- Facility to call RM if there are issues (Other popular brokers always have busy lines)

Cons

- Margin funding is given to the customers without notice. This causes major confusion and customers paying hefty interest charges.

- Angel one doesn't offer trading in SME shares.

- Angel RM and the sales team tries to cross sell other products and services.

- GTC/GTT order facility not available.

- Doesn't offer a 3-in-1 account.

Features of Angel One Trading Apps

Angel One provides broking services through multiple trading platforms – web, mobile and installable executable – which are free for customers to use.

User-friendly Interface

The app has a user-friendly interface that allows investors to trade with ease. It has a simple and intuitive design that makes it easy for even novice investors to use the app.

Real-time data and alerts

The app provides real-time market data and news updates to keep investors informed about the latest market trends and news.

Advanced Charts

The app has advanced charting tools that help investors analyze stocks and other securities in detail. These charts include technical indicators, trend lines, and other useful tools.

Research Reports

The app provides comprehensive research reports on stocks and other securities that help investors make informed decisions.

One-Click Trading

The app allows investors to trade with just one click, making it easier to place orders quickly.

Multiple Order Types

The app supports multiple order types, including limit orders, stop-loss orders, and market orders, which give investors more control over their trades.

Brokerage Plans in Angle One

| Account Opening Charges | Free |

| Trade-In | BSE, NSE, MCX, NCDEX |

| Account Maintenance Charges | 240 Rupee, Rs.0 in first year |

| Call and Trade Charges | 20 Rupee |

| Equity Delivery Brokerage | Zero |

| Equity Intraday Brokerage | 0.03% |

| Equity Futures Brokerage | 0.25 % |

| Equity Options Brokerage | 20 Rupee |

| Currency Futures Brokerage | Zero |

| Commodity Futures Brokerage | 0.25% |

| Commodity Options Brokerage | ₹ 20 MARGINS |

| Equity Delivery Margin | 1x |

| Equity Intraday Margin | 4x |

| Equity Futures Margin | 4x |

| Equity Options Margin | 3x/4x |

| Currency Futures Margin | 4x |

| Currency Options Margin | 3x/4x |

| Commodity Futures Margin | 4x |

| Commodity Options Margin | 0x |

Angel One Account Opening Process

Online Account Opening Process

- You need to fill in all the details in the Sign Up form.

- An online account opening link will now be sent to you.

- Now, you will receive an OTP on your registered mobile number.

- Next, you just need to provide your PAN Number and date of birth, along with your bank details.

- Complete all the KYC details and then you will receive your demat account details in your registered Email address.

Documents Required

It is advised that you keep scanned copies of the following documents:

- Aadhar Card

- PAN Card

- Bank proof (Cancelled cheque/Passbook/Bank account statement)

- Mobile or laptop webcam

- Passport size photo

Frequently Asked Questions

Angel One provides equity delivery at zero brokerage charges; on other trades such as intraday, futures, options and currency investments there will be either Rs 20 per executed order or 0.2% of transaction value depending on which is less.

Angel One Broker Services in India provides full-service brokerage and discount brokerage services online and through traditional channels for their customer base, having over 20 years experience and one of the top trading platforms available online. They pride themselves on building long-lasting customer relationships.

Angel Broking is an extremely safe stock broker for trading and investment. One of the world's premier stockbrokers since 1987, they are members of BSE, NSE and MCX markets and boast one of their own trading floors in New Delhi.

Angel One Limited (formerly Angel Broking Limited) was established as an Indian stockbroker firm in 1996 and holds membership on Bombay Stock Exchange, National Stock Exchange of India, National Commodity & Derivatives Exchange Limited and Multi Commodity Exchange of India Limited.

Other Broker Reviews

Angel One

Angel one is a leading full-service brokerage firm in India that offers a user-friendly

Upstox

Upstox is a discount brokerage firm that offers a trading app called Upstox Pro.

Alice Blue

Alice Blue is a discount brokerage firm that offers a trading app called Alice Blue

ICICI Direct

ICICI Direct is a full-service brokerage firm that offers a trading app called.

Top Brokers in India with Best Trading Apps

The world of trading has been revolutionised in recent years by the introduction of trading apps.

These apps have made trading more accessible, convenient, and affordable than ever before, allowing people to trade on-the-go using just their smartphone or tablet. With so many trading apps available on the market, it can be difficult to know which one to choose.

We’ll take a look at some of the best trading apps in India available today, comparing Angel One, Zerodha, Upstox, Alice Blue, SAMCO, and ICICI Direct.

Angel One

Angel One is a leading full-service brokerage firm in India that offers a user-friendly trading app.

Upstox

Upstox is a discount brokerage firm that offers a trading app called Upstox Pro.The app offers features.

Alice Blue

Alice Blue is a discount brokerage firm that offers a trading app called Alice Blue Wave.

ICICI Direct

ICICI Direct is a full-service brokerage firm that offers a trading app called ICICI Direct Mobile. The app offers.

Samco

SAMCO is a discount brokerage firm that offers a trading app called SAMCO Trader.

Zerodha

Zerodha is a discount brokerage firm that offers a popular trading app called Kite.

5 paisa

5paisa is a financial services company that offers a wide range of services.

Compare Stock Brokers

Streamline your trading journey with our detailed stock broker comparisons for informed investment decisions.

Learn Trading

Master the art of trading with our comprehensive learning resources and expert guidance for confident investment strategies.

Latest Offers

Stay ahead of the game with our curated list of the latest offers from top broker apps for exclusive trading advantages.