Upstox Review 2023

- Home

- Upstox Review 2023

Upstox Pro Trading App: Features, Benefits & Comparison

Upstox is India’s tech-first low cost broking firm offering trading opportunities at unbeatable competitive rates across various segments, such as stocks, commodities, currency futures and options – accessible on its Upstox Pro Web and Upstox Pro Mobile trading platforms.

Upstox is supported by an international consortium of investors including Kalaari Capital, Ratan Tata and GVK Davix.

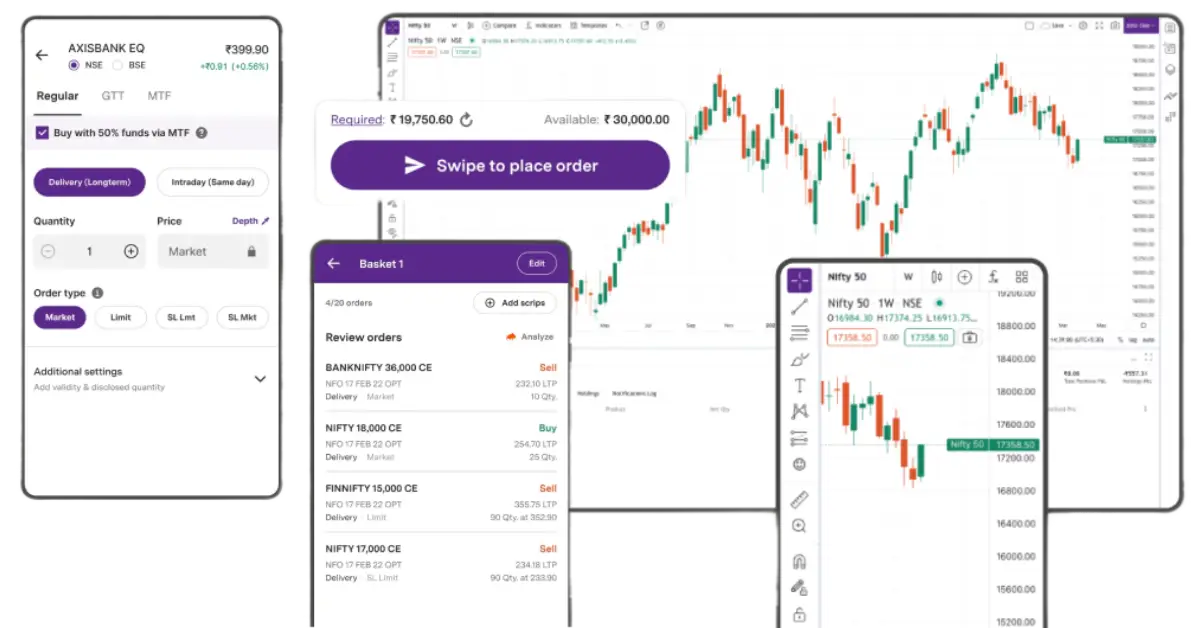

Upstox trading platform provides trading, analysis and charting features which make placing orders simple from mobile phones or web browsers. Built upon Omnesys NEST OMS (Order Management System) and Omnesys NEST RMS (Risk Management System).

Upstox Pro offers trading in Equity F&O, Equity Indra-Day, Commodities, and Currency Derivatives through Upstox’s paid service for traders – Upstox Pro.

Upstox Charges 2023

Upstox Account Opening Charges: Rs 0 (Free)

Upstox Demat AMC: Rs 150 per year

Upstox Equity Delivery & Intraday Charges

Upstox equity delivery brokerage fees start from Rs 20 or 2.5% (whichever is lesser per order), while intraday brokerage rates for executed orders is 20 rupees or 0.025%, depending on which is lower.

| Upstox Charges | Equity Delivery | Equity Intraday |

|---|---|---|

| Brokerage | Rs 20 per executed order or 2.5% (whichever is lower) | Rs 20 per executed order or 0.05% (whichever is lower) |

| Securities Transaction Tax (STT) | 0.1% on both Buy and Sell | 0.025% on the Sell Side |

| Transaction / Turnover Charges | NSE Rs 345 per Cr (0.00345%) | BSE Rs 300 per Cr (0.003%) (each side) | NSE Rs 345 per Cr (0.00345%) | BSE Rs 300 per Cr (0.003%) (each side) |

| Goods and Services Tax (GST) | 18% on (Brokerage + Transaction Charge) | 18% on (Brokerage + Transaction Charge) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Charges | 0.015% (Rs 1500 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

| Demat Transaction Charges | Rs 18.5 per scrip (only on sell) | Rs 0 |

Upstox Equity F&O Charges

Upstox Equity F&O brokerage fees start from Rs 20 or 0.05% of an executed order (whichever is the greater).

| Upstox Charges | Equity Futures | Equity Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| Securities Transaction Tax (STT) | 0.1% (on Sell Side) | 0.05% (on Sell Side) |

| Transaction / Turnover Charges | Rs 190 per Cr (0.0019%) | Rs 5000 per Cr (0.05%) (on premium) |

| Goods and Services Tax (GST) | 18% on (Brokerage + Transaction Charge) | 18% on (Brokerage + Transaction Charge) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Charges | 0.002% (Rs 200 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

| Demat Transaction Charges | Rs 0 | Rs 0 |

Upstox Currency Charges

Upstox Currency brokerage costs Rs 20 or 0.05% (whichever is lesser).

| Upstox Charges | Currency Futures | Currency Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| Securities Transaction Tax (STT) | No STT | No STT |

| Transaction / Turnover Charges | NSE Rs 90 per Cr (0.0009%) | BSE Rs 22 per Cr (0.00022%) | NSE Rs 3500 per Cr (0.035%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Goods and Services Tax (GST) | 18% on (Brokerage + Transaction Charge) | 18% on (Brokerage + Transaction Charge) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Charges | 0.0001% (Rs 10 per crore) on buy-side | 0.0001% (Rs 10 per crore) on buy-side |

Upstox Commodity Charges

Upstox Commodity brokerage charges either Rs 20 per executed order, or 0.050% (whichever is less).

| Upstox Charges | Commodity Futures | Commodity Options |

|---|---|---|

| Brokerage | Rs 20 per executed order or 0.05% (whichever is lower) | Flat Rs 20 per executed order. |

| Securities Transaction Tax (STT) | 0.01% on sell trade (Non-Agri) | 0.05% on sell trade |

| Transaction / Turnover Charges | Group A - Rs 260 per Cr (0.0026%) | N/A |

| Goods and Services Tax (GST) | 18% on (Brokerage + Transaction Charge) | 18% on (Brokerage + Transaction Charge) |

| SEBI Charges | 0.0001% (Rs 10/Crore) | 0.0001% (Rs 10/Crore) |

| Stamp Charges | 0.002% (Rs 200 per crore) on buy-side | 0.003% (Rs 300 per crore) on buy-side |

Upstox Charge Explained:

- STT: Sell side Transaction Tax is charged only on intraday and F&O trades; delivery trades in Equity incur both charges.

- Stamp Duty: Charges vary according to where a customer resides in each state.

- Goods and Services Tax (GST): GST will be assessed as 18% of the total brokerage and transaction charges cost.

- SEBI Turnover Fees: SEBI turnover fees are assessed at Rs 10 per Crore of turnover volume.

Other Charges (Upstox Broker Hidden Charges / Fees):

- Call and Trade Order Executions cost Rs 20 each,

- Physical contract notes will cost Rs 25 each plus courier charges (digital contract notes are free of charge).

- Instant Money Transfer fee per transfer : Rs 7.

Upstox Online Account Opening

To open an account with Upstox; please leave your information and one of their representatives will reach out shortly.

Upstox Pros and Cons

Here are the advantages of Upstox: it must read both its advantages and disadvantages before opening an account with Upstox; reading upstox pros and cons can help determine whether Upstox meets your investment needs or not.

Pros

- No fees apply when opening online accounts.

- Flat Rs 20 brokerage per trade for delivery, intraday and F&O transactions.

- No software licence fees apply and advance order types such as AMO, CO, SL and GTT can be ordered as required.

- Margin Trading Facility (MTF) can be obtained with interest charges of Rs 20/day on slabs of Rs 40,000 or above.

- Margin against Shares is now available.

- Upstox Pro Web Trading Platform features several indicators to keep tabs on markets while on-the-go.

- Upstox Bridge for AmiBroker provides you with everything you need to successfully code and implement your trading strategy using the AmiBroker AFL editor.

- Upstox Developer Console makes it simple and efficient for you to code (develop) your own trading app using popular programming languages such as Python.

- Upstox Option Chain Tool assists traders in quickly finding out Spot, Future prices and vertical comparison of rates; circuit levels; Open High Low Close; market depth as well as measuring volatility, open Interest performance indicator greeks are available as additional services to users.

- Upstox MF Platform offers hundreds of mutual funds that customers can invest in using either Lump Sum or SIP investment plans.

Cons

- Brokerage fees associated with stock deliveries typically amount to Rs 20 per trade; many brokers offer such deliveries without additional brokerage costs.

- Upstox does not offer unlimited monthly trading plans.

- Margin funding isn't currently available for delivery trades.

- Does not offer stock tips or recommendations.

- Provides only 2-in-1 accounts.

- Not providing 24/7 customer support.

- Does not provide API access for automated trading.

- Do not offer NRI Trading and Demat accounts.

- Call-and-trade fees start from Rs 20 per executed order.

- Automatic settlement costs an extra Rs 20 for every successfully executed order.

Upstox ₹0 AMC Plan

Account Opening Charges

Free

Equity Intraday Brokerage

₹20

Research Reports & Trading Calls

No

Equity Delivery Brokerage

–₹0

Account Maintenance Charges

₹20+Tax/Month

F&O/ Commodity Brokerage

–₹20

Broker Type

Discount

API Charges

₹0 per Month

Features of Upstox Trading App

Upstox provides mobile and website-based trading. RKSV built its trading platform specifically to make placing orders simple from both devices; currently no trading terminal is offered by Upstox.

User-friendly Interface

The app has a user-friendly interface that allows investors to trade with ease. It has a simple and intuitive design that makes it easy for even novice investors to use the app.

Real-time data and alerts

The app provides real-time market data and news updates to keep investors informed about the latest market trends and news.

Advanced Charts

The app has advanced charting tools that help investors analyze stocks and other securities in detail. These charts include technical indicators, trend lines, and other useful tools.

Research Reports

The app provides comprehensive research reports on stocks and other securities that help investors make informed decisions.

One-Click Trading

The app allows investors to trade with just one click, making it easier to place orders quickly.

Multiple Order Types

The app supports multiple order types, including limit orders, stop-loss orders, and market orders, which give investors more control over their trades.

Upstox is one of the top trading platforms available that makes investing easy, from money transfer between accounts to SEBI registration safety measures and even prominent investors such as Ratan Tata or Tiger Global investing their capital with them.

Upstox currently provides India's premier Demat account for beginners.

- Does not offer stock tips or recommendations.

- Provides only 2-in-1 accounts.

- Not providing 24/7 customer support.

- Does not provide API access for automated trading.

- Do not offer NRI Trading and Demat accounts.

- Call-and-trade fees start from Rs 20 per executed order.

- Automatic settlement costs an extra Rs 20 for every successfully executed order.

Upstox is a real stock broker run by RKSV Securities India Pvt Ltd of Mumbai since 2012. Their business memberships include NSE, BSE, MCX CDSL NSDL.

Other Broker Reviews

Angel One

Angel one is a leading full-service brokerage firm in India that offers a user-friendly

Upstox

Upstox is a discount brokerage firm that offers a trading app called Upstox Pro.

Alice Blue

Alice Blue is a discount brokerage firm that offers a trading app called Alice Blue

ICICI Direct

ICICI Direct is a full-service brokerage firm that offers a trading app called.

Top Brokers in India with Best Trading Apps

The world of trading has been revolutionised in recent years by the introduction of trading apps.

These apps have made trading more accessible, convenient, and affordable than ever before, allowing people to trade on-the-go using just their smartphone or tablet. With so many trading apps available on the market, it can be difficult to know which one to choose.

We’ll take a look at some of the best trading apps in India available today, comparing Angel One, Zerodha, Upstox, Alice Blue, SAMCO, and ICICI Direct.

Angel One

Angel One is a leading full-service brokerage firm in India that offers a user-friendly trading app.

Upstox

Upstox is a discount brokerage firm that offers a trading app called Upstox Pro.The app offers features.

Alice Blue

Alice Blue is a discount brokerage firm that offers a trading app called Alice Blue Wave.

ICICI Direct

ICICI Direct is a full-service brokerage firm that offers a trading app called ICICI Direct Mobile. The app offers.

Samco

SAMCO is a discount brokerage firm that offers a trading app called SAMCO Trader.

Zerodha

Zerodha is a discount brokerage firm that offers a popular trading app called Kite.

5 paisa

5paisa is a financial services company that offers a wide range of services.

Compare Stock Brokers

Streamline your trading journey with our detailed stock broker comparisons for informed investment decisions.

Learn Trading

Master the art of trading with our comprehensive learning resources and expert guidance for confident investment strategies.

Latest Offers

Stay ahead of the game with our curated list of the latest offers from top broker apps for exclusive trading advantages.