Angel One Frequently Asked Questions Guide: Established in 1987, Angel One (Angel One) stands as one of India’s leading full-service retail brokers, providing online discount brokerage services. The company extends a broad range of investment and trading amenities, containing stock and commodity broking, investment advisory services, margin funding, loans against shares, and more. Do you have questions related to the Angel One share trading account or the Angel One Demat account? Get all your share trading doubts by reading this blog “Angel One Frequently Asked Questions Guide”.

What is Angel One?

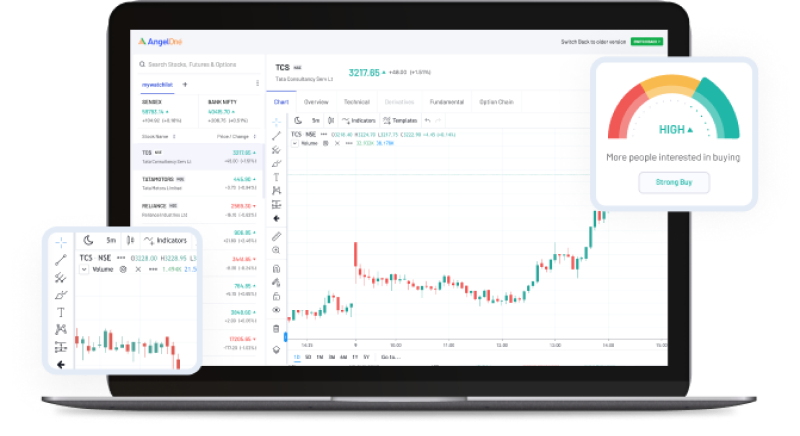

Angel One, a leading Indian brokerage, offers a range of advanced services, including online trading, advisory, margin trading, and algorithmic trading. Utilizing cutting-edge tools like basket orders and SmartAPI, they enable efficient navigation of capital markets.

Is Angel One secure for trading and investment?

It is commonly asked among the various Angel One Frequently Asked Questions Guide thus, it was established in 1987 and is a secure stock broker for trading and investment. It is among the largest full-service stock brokers in India and holds membership with regulatory bodies such as SEBI, BSE, NSE, MCX, and NCDEX.

What is the Margin at Angel One?

Margin at Angel One involves borrowing money from the brokerage firm to amplify an investment, allowing you to pay only a percentage (margin) of the cost, with the rest borrowed. Angel One provides a margin ranging from 1x up to 30x.

What are the charges for futures at Angel One?

One of the Frequently Asked Questions for Angle One is it charges for futures so for equity, currency, and commodity futures trading, Angel One charges Rs 20 per executed order.

How can one avoid DP charges in a Demat Account?

DP charges, associated with selling shares from a Demat Account, are unavoidable in delivery trades. However, there are strategies to minimize these charges:

- Close your position intraday.

- Engage in BTST trades.

- Trade in the futures segment.

What is the process for withdrawing money from Angel One?

To withdraw funds from your AngelOne account:

- Log in to your AngelOne account.

- Click on “Menu.”

- Choose “Funds.”

- Check the Releasable Amount under the “Withdrawals” tab.

- Enter the Withdrawal Amount (must be less than the Releasable Amount).

- Confirm the withdrawal request by clicking “Submit.”

How can one change the linked bank account in Angel One online?

To modify the linked bank account in Angel One:

- Download the Account Details Modification Request Form.

- Print and fill out the form, signing it.

- Attach a cancelled cheque or bank passbook copy.

- Submit or courier the form to your Angel One branch.

Is Angel One’s trading account cost-effective?

Angel One’s online trading account opening is free. Visit www.angelone.in, fill out the Account Opening form, and start cost-effective trading in various securities, including stocks, gold, ETFs, currencies, etc., all on a single platform.

What are the commodity charges imposed by Angel One?

For commodity trading, Angel One charges Rs 20 per executed order for both commodity futures and options. Commodities futures involve agreements to buy or sell raw materials in the future, while commodity options grant the right to buy or sell underlying commodity futures at predetermined prices.

How can one cancel SIP in Angel One?

Cancelling Mutual Funds SIP in Angel One is straightforward:

- Log in to the Angel Bee app or website.

- Visit ‘My Transaction’ > SIP.

- Select the SIP to cancel.

- Click the Cancel button.

- Check the status in the Order Book section.

What are the delivery charges at Angel One?

Another common frequently asked question for Angle One is it’s delivery charges, thus for equity delivery trades, Angel One charges Rs 0 (Free). Additional costs may include taxes, demat debit transaction fees (Rs 13.5 per trade), and exchange transaction charges for Espresso customers.

Does Angel One offer Mutual Funds?

Yes, Angel One provides the option to buy/sell Mutual Funds if you have an account with them.

What are the charges for options at Angel One?

Angel One charges Rs 20 per executed order for equity, currency, and commodity options trading. Options are leveraged derivative products commonly used for hedging or risk reduction in portfolios.

What are the charges for intraday trading at Angel One?

Angel One charges Rs 20 per executed order for intraday trades, also known as Margin Intraday Square-up or MIS orders. These orders are automatically squared off at the end of the day, providing extra leverage. Additional costs include taxes and exchange transaction charges.

What is the intraday auto square-off time at Angel One?

Angel One automatically squares off all open intraday positions at 3:15 PM.

hat are the brokerage charges at Angel One?

It is the most important Angel One Frequently Asked Questions Guide offering zero brokerage charges for long-term delivery trades and a maximum of Rs. 20 per trade for Intraday, F&O, and other trades. Specific segment-wise brokerage charges can be viewed by following the provided link.

What are the transaction charges at Angel One?

Common Frequently Asked Question for Angle One is its Transaction charges (Exchange Turnover Charges) which are fees imposed by stock exchanges for trades. Most brokers, including Ange

| Segment | Transaction Fee |

| Equity Intraday | NSE Rs 325 per Cr (0.00325%) | BSE Rs 325 per Cr (0.00325%) (sell side) |

| Equity Futures | NSE Rs 190 per Cr (0.0019%) | BSE Rs 0 |

| Equity Options | NSE Rs 5000 per Cr (0.05%) | BSE Rs 500 per Cr (0.005%) (on premium) |

| Equity Delivery | NSE Rs 325 per Cr (0.00325%) | BSE Rs 325 per Cr (0.00325%) (each side) |

| Currency Options | NSE Rs 3500 per Cr (0.035%) | BSE Rs 100 per Cr (0.001%) (on premium) |

| Commodity | MCX Rs 150 per Cr (0.0015%) | NCDEX Rs 300 per Cr (0.003%) |

| Currency Futures | NSE Rs 90 per Cr (0.0009%) | BSE Rs 22 per Cr (0.00022%) |

Does Angel One offer a trial trading account?

Yes, Angel One provides a trial account for new investors to practice trading without financial risk. Users can register, log in, and trade virtual securities in real time, gaining market experience without actual losses.